Dealing with Hunger through Marginal Means

In dealing with the issue of world hunger, there are too many factors to take into consideration, whether they are food accessibility and allocation, education, food storage, and infrastructure issues. Despite the complexity of the situation, all these factors can be accounted for through economic sustainability, the ability for individuals or enterprises to make a prolonged profit independently using surrounding resources. By promoting economic sustainability for the 2.8 billion people living on less than $2 a day (Khavul, 2010), the disparity between the wealthy and the poor will shrink, thus increasing the purchasing power of the impoverished.

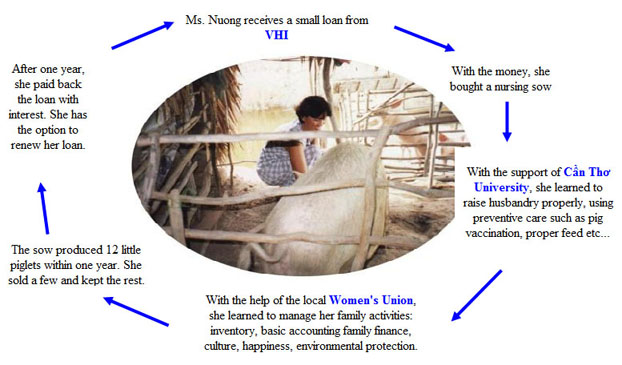

(Ruben, 2007)

Problem

Those who live in poverty-stricken regions are unable to attain capital for start-up entrepreneurial initiatives (new businesses, services, etc..) due to lack of credit, lack of financial institutions, and lack of investment opportunities.

Solution

An increase in microfinancing institutions (MFIs) in developing regions can increase access to capital to the poor through small loans as opposed to large loans, with a focus towards projects involving staple crops (i.e. rice, wheat) and other agricultural ventures. Whereas traditional banks find it unprofitable to invest in individuals without any information on their creditworthiness, microfinancing institutions utilize joint liability group lending to share the responsibility of repayment to a group, lowering the risk of investment. There are risks that microfinancing institutions take by investing in this larger demographic. Because there is a lack of adequate technological infrastructure to relay information, these institutions must rely on anecdotal evidence from its clients to gauge their creditworthiness, as opposed to using quantitative data to approach the problem . Furthermore, because there is a lack of adequate physical infrastructure, the administrative costs of reaching the clientèle and keeping record of their transactions increases tremendously. (Khavul, 2010)

With the current microfinance system, there have been few quantitative evaluations of institutions and their impacts on the economic climate of their regions. Papers that do expound on the positive aspects of microfinancing often use anecdotal evidence as opposed to actual figures, and so it is difficult to gauge the current effectiveness of microfinancing (Westover, 2008). At the same time, papers that contest the effectiveness of microfinace also suffer from a lack of concrete evidence. Of course though, there are case studies that aver the potential for microfinance to alleviate poverty that uses measured statistics. Khandker’s 2005 article, “Microfinance and Poverty: Evidence Using Panel Data from Bangladesh,” examined 1,638 households participating in a microcredit program between 1991/92 and 1998/99. Khandker determined that moderate poverty (measured as individuals who live off between 1,739 and 2,112 calories per day) declined 17% over that time period while extreme poverty (individuals who live off less than 1,739 calories per day) decreased by 12% (Khandker, 2003). In this particular case, there were measurable gains, but this does not diminish the fact that there is a lack of transparency in the microfinancing system. In addition to implementing these institutions around the world, they must be willing to go through extensive evaluation. They must submit any quantitative data such as gross loan portfolios, total assets, total borrowings, and total equity to the Microfinance Information eXchange (MIX) if they are to receive funding from International Financing Institutions (IFIs) and private donors.

Where will these institutions be implemented?

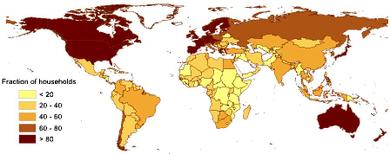

The graphic to the left (Beck, 2007) shows the percentage of households with a banking account, implying that darker regions have better access to capital and saving services than the lighter regions (Beck, 2007). The primary areas where microfinancing institutions will be implemented and be put to most use are the lighter regions, (i.e. Sub-Saharan Africa, India, Latin America, and the Middle East). More specifically, MFIs will not be focused necessarily in areas of high-population densities, but rather in outlying areas where such investment institutions are scarce and limited. Though of course, we must gauge the need of institutions in these regions so as to avoid simply placing them in areas where they are not present. In doing so, we avoid saturating the region to the point of inefficient transaction. This proposal must take into consideration any infrastructure (or lack thereof) and be implemented in conjuncture to any plans of infrastructure investment.

How will these institutions be implemented?

Because the overall aim of this proposal is to lower the prevalence of malnutrition and undernourishment in developing regions and increase food production, there will be an incentive system set up so that those who wish to start up any entrepreneurial ventures relating to the growth, storage, and transport of staple crops and general food products. In setting the range of APR (Annual Percentage Rate) for loans in specific countries, individuals and or groups who choose to work in agricultural ventures will receive a lower APR than would otherwise be the normal value. In this way, the viability of such a project increases, and, on an aggregate level, increase food production. At the same time, for those uninterested in agriculture, the APR difference will not be so significant as to deter them from an entrepreneurial venture entirely; poor regions are accustomed to large APRs, so the difference will be of little consequence in that particular respect. These projects are targeted towards encouraging developing regions to grow and distribute their own foods. So, the issue of distribution inequalities is bypassed significantly, for more likely than not, these foods (inferior goods) will be purchased by the poor as opposed to the wealthy. In a phrase, grown by the poor, for the poor.

Finances 1: How much will each MFI charge for interest (APR)?

MFIs charge an unusually high APR for loans, considering they have low economies of scales and focus on smaller loans as opposed to large loans. To set an adequate APR for specific regions, preexisting APRs must be taken into account, and be ranged between commercial bank rates and APR moneylender sources.

Table 1 Annual Interest Rates of Commercial Banks, Moneylenders, and MFIs (approximately 2003)

|

Country |

Commercial Bank APR |

MFI APR |

Informal Sources APR |

|

Indonesia |

18% |

28–63% (BPRs, local-level microbanks) |

120–720% |

|

Cambodia |

18% |

~ 45% |

120–180% |

|

Nepal |

11.5% (priority sectors) 15–18% (other) |

18–24% |

60–120% |

|

India |

12–15% (to SMEs) |

20–40% |

24–120% (depending on state) |

|

Philippines |

24–29% |

60–80% |

120+% |

|

Bangladesh |

10–13% |

20–35% |

180–240% |

(Reille, Helms, 2004)

Source: Wright and Alamgir, Microcredit Interest Rates in Bangladesh, based on data prepared by Sanjay Sinha.

Based on this table of APR values from varying countries, generally speaking, moneylenders charge much more than MFIs, and MFIs more so than commercial banks.

Each MFI's APR must be set to accommodate the different economic climate from region to region.

By comparing the ranges of APR values of commercial banks to the range of MFI, an acceptable range can be set in place where MFIs are scarce and limited can be found.

Where MFIs are not prevalent, an APR range model would follow as such:

(Average commercial bank range in applicable region)*(1.5) = Lower limit of acceptable MFI APR range

(Average commercial bank range in applicable region)*(3.5) = Upper limit of acceptable MFI APR range

Take for instance a hypothetical country of commercial bank APR range of 15%-17%

*Average commercial bank range = 16%

*Lower Limit of MFI APR range = 24%

*Upper Limit of MFI APR range = 56%

*(hypothetical example, does not represent actual values for implementation)

This follows the general trend of how commercial banks and MFIs correspond with their APR values.

Once an MFI system is established in a region, this range will govern their APR for loans, with discrepancy given to the respective institutions, following the general guideline that clients seeking agricultural ventures will receive lower APRs to add incentive to food production, distribution, etc...

Finances 2: Increase by how much (institutions)?

(Ruben, 2007)

Although MFIs have reached out to the impoverished, there is still a disparity between those lacking access to capital and the institutions available. With Asia, Africa, the Middle East, and Latin America and the Caribbean as part of the main focus of the MFI network, the disparity must be filled. With an estimated 10,000 MFIs in existence in 2007, serving over 113 million clients (Ming-Yee, 2007), an economically realistic goal is to aim for an additional 700 million clients to make use of microfinancing (roughly ¼ of the population living on less than $2 a day). Following the current trend of MFI access to clientèle, an additional 62,000 MFIs must be established in Asia, Africa and the Middle East, and Latin America and the Caribbeans. Specifically, 36,900 will need to be allocated to Asia, 20,300 in Africa and the Middle East, and 4,800 in Latin America and the Caribbeans. Location-wise, this will depend on the existing infrastructure and proposed infrastructure investments so that transaction costs between clients and MFI will decrease. Based on the amount that IFIs invest into MFIs, and that in 2006 they invested $2.3 billion which accounted for 36% of all investment for the 10,000 strong industry (Ming-Yee, 2007), around $40 billion dollars will be needed to start up the needed 62,000 MFIs. Of course, after taking into consideration the other proposals and their estimated costs, this project to expand MFI can be downsized to accommodate the costs to infrastructure investments, food distribution, and storage.

62,000 MFIs is the maximum number of institutions to establish, in that this report does not take into account the increase in aggregate number of borrowers in preexisting MFIs, which from 2003-2008 has grown on an average of 23% per year (Gonzalez, 2010). Factoring this in, the proposed expansion of new MFI would be too much, and should be seen as the maximum number of MFIs that will more than likely not be necessary.

Who will fund the project/organizations that we can work with?

There are already around 100 private equity funds that manage close to $6.5 billion and channel money to microfinancing organizations, as well an individual investors that participate via online aggregators such as MicroPlace and Kiva (Khavul, 2010). Additional financing can be obtained from international financing institutions, microfinance investment funds, development agencies, private donors (NGOs), and Apex institutions (Ming-Yee, 2007).

(Ming-Yee, 2007)

Time scale

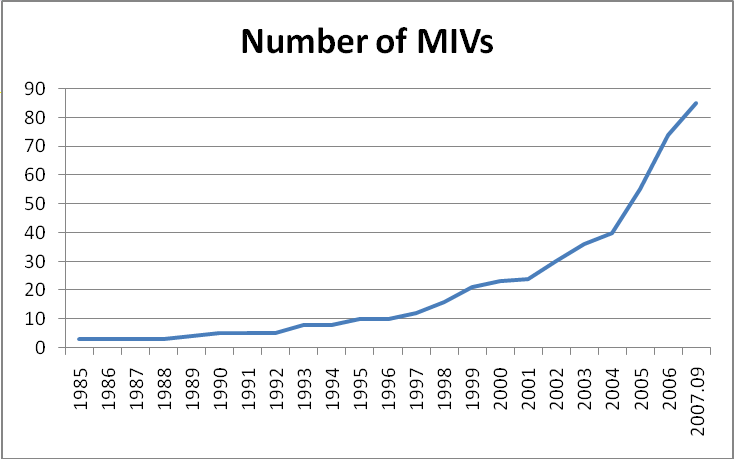

The growth of Microfinance Institution Vehicles (MIVs, that help finance MFIs) over the past 25 years is an indicator of the growth of the MFI system itself, and can provide information as to how fast the market is growing for MFI and thus can give an estimate for how long it will take to reach the desired additional 62,000 MFI goal. Taking into consideration current trends (consistent exponential growth of borrowers with the same MFIs already in place) it would take around 10 years to reach the desired goal. This, of course, is unrealistic, and to factor in the growth of MFIs in a safe and sustainable manner, 40 years instead should be the range in which expansion takes place, factoring increases in MFI and in borrowers over that period. The goal is by 2050, more than ¼ of the impoverished population will have access to MFIs. Essentially, $1 billion dollars must be invested into the MFI industry per year for 40 years to foster a slow and sustainable growth, as opposed to the unsustainable and unrealistic exponential trends depicted by the growth of MIVs.

Because microfinance can serve as an integral part of the solution to world hunger through a agricultural focus initiative, and will help alleviate poverty in developing regions in order to increase the purchasing powers of poor families, there must be an extensive and exhaustive research committee that involves the economics, distribution, agricultural and innovation, and to a lesser extent, social change (though this proposal makes due, and in fact prospers, from the social stigma prevalent in regions lacking in welfare safety nets). Of course, this is only a part of the entire solution, and will incorporate all other aspects of the economic approach towards food security.

Khavul, S. (2010). Microfinance: creating opportunities for the poor?. Academy of Management Perspectives. Retrieved November 29, 2010, from http://www.google.com/url?sa=t&source=web&cd=1&ved=0CBMQFjAA&url=http%3A%2F%2Fww...

Beck, T. (2007, November 13). Finance for all? policies and pitfalls in expanding access. Retrieved November 29, 2010, from http://psdblog.worldbank.org/psdblog/2007/11/finance-for-all.html

Reille , X, & Helms, B. (2004, September). Interest rate ceilings and microfinance: the story so far. Retrieved November 29, 2010, from http://www.cgap.org/p/site/c/template.rc/1.9.2703/

Ruben, M. (2007, May). The promise of microfinance for poverty relief in the developing world. Retrieved November 29, 2010, from http://www.csa.com/discoveryguides/microfinance/review3.php

Ruben, M. (2007, May). The promise of microfinance for poverty relief in the developing world. Retrieved November 29, 2010, from http://www.csa.com/discoveryguides/microfinance/reviewf.php#v1

Ming-Yee, H. (2007, November 23). The international funding of microfinance institutions: an overview. Retrieved November 29, 2010, from http://www.google.com/url?sa=t&source=web&cd=1&ved=0CBMQFjAA&url=http%3A%2F%2Fww...

Gonzalez , A. (2010, June). Is microfinance growing too fast? Retrieved November 29, 2010, from http://www.themix.org/publications/mix-microfinance-world/2010/06/microfinance-g...

Westover, J. (2008). The record of microfinance: the effectiveness/ineffectiveness of microfinance programs as a means of alleviating poverty. Electronic Journal of Sociology, Retrieved from http://www.sociology.org/content/2008/_westover_finance.pdf

Khandker, S. R. (2008). Micro-finance and poverty evidence: using panel data from bangladesh. Policy Research Working Paper Series, Retrieved from http://www-wds.worldbank.org/servlet/WDSContentServer/WDSP/IB/2003/02/15/0000949...